There are two basic truths of social science that technologists scanning the news in recent weeks may appreciate. First, despite arguments about the rise and fall of the state, most countries are considerably less orderly and cohesive on the inside than they look at first glance. In other words, the “monopoly of force” and the “Westphalian state” are convenient fictions. Second, illicit markets are low-trust environments where nasty punishments for breach of contract are commonplace. The terrifying ripple effects that the closure of illicit markets can generate is a testament to the ugly nature of the social relations that produce them.

Amidst the chaos of the government shutdown and a possible debt default, an well-off Oakland neighborhood is reacting to harsh law enforcement budget cuts by crowdfunding their own security services:

In Rockridge, the answer has been to crowdfund private security services, with the aim of compensating for an understaffed police department in the city with the highest robbery rate in America. In the last few weeks three separate campaigns have been started on Crowdtilt in order to fund four months of private security patrols in three different section of Rockridge. Near $35,000 have been raised so far, and two of the three projects have raised enough funds to ensure they will move forward.

Ethan Zuckerman notes that crowdfunded security is only the latest and greatest episode in a wave of crowdfunded responses to the erosion of efficient government services and decaying infrastructure. In many municipalities across the country, government services (or their equivalent) are only available if you directly pay for them. From “Kickstarter urbanism” or crowdfunded armed guards on the patrol, crowdfunded services are increasingly springing up across America. This is fairly predictable. In the absence of strong governing institutions, self-help becomes the order of the day. And absent institutional incentives, efforts to provide for the common good often falter.

Zuckerman worries that crowdfunding perpetuates inequality, as it potentially reduces the incentive to pay for government services and also leaves out those unable to afford it. But, as Rockridge resident Steve Kirsh noted in response to a fellow crowdfunder lamenting that these services should be provided by the government they pay taxes to: “welcome to America!” If trends in economic inequality and government dysfunction continue linearly, crowdfunded civic services will likely become a pervasive aspect of American life.

On the more seedy side, the FBI’s recent bust of Silk Road founder and illicit market impresario Ross William Ulbricht has unwittingly stimulated an interesting natural experiment in “dark network” economics. Why? A recent Buzzfeed post explains:

In order to buy something on Silk Road, you first have to transfer funds to your account. Since these funds are Bitcoins, and since Bitcoin transfers are final and permanent, any money held in a Silk Road account is no longer available to the users who deposited it. …..Silk Road has processed hundreds of millions of dollars in orders in a virtual currency, so expect the ripple effects of this shutdown will be massive.

The Buzzfeed post links to a Reddit forum concerning all matters Silk Road that documents enough small-time dealers panicking to fill an entire season of The Wire. Users suddenly found themselves without access to their accounts, and fretted about running afoul of Paulie Cicero’s famous rule concerning uncontrollable circumstances that prevent his business partners from coming up with the money. Given the opacity of the illicit network Ulbricht facilitated, we are probably unable to truly map ripple effects of his arrest. But it is safe to assume that some bones will be broken and Jimmy Hoffawill get some unexpected (permanent) neighbors.

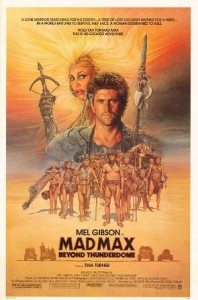

Like the fictional Bartertown depicted in Mad Max: Beyond Thunderdome, Ulbricht’s Silk Road was an illicit bazaar that held together many private arrangements. Here was a rough and tumble place where money and services could change hands in an environment without cumbersome state regulation. However, in low-trust environments without institutions capable of arbitrating disputes, the only rule set that enables commerce is costly punishment that both deters breach of contract and obtains satisfaction for business losses. As Tina Turner famously stated to Mel Gibson’s itinerant road warrior, “bust a deal, face the wheel.”

Technologists looking to understand the latest trends should understand that economic demand for online services preferred by affluent neighborhoods crowdfunding to ward off Glock-toting lumpenproletariat or enterprising small businessmen using bitcoins to emulate a certain New Mexico high school chemistry professor are both functions of fairly old social rule sets. And those seeking to understand the computational future will miss the impact of these social rule sets if they, as data scientist Drew Conway observed, continuously turn to only those with backgrounds in purely technical subjects.

Recent Reporting on Bitcoin:

What You Need To Know About Bitcoin: Including potential new business models to consider

OODAloop nails it again with reporting on Bitcoin price manipulation

Today Every Company Buys Electricity, Tomorrow Every Company Will Buy Ethereum

Smart Cities Cybersecurity Challenge

Blockchain Templates: Amazon Making Technology Mainstream

What Executives Should Know About Ethereum

Cryptocurrencies and their promise for enterprise technology professionals