By now, readers will likely have caught themselves up with the twists and turns of Newsweek‘s apparently ill-fated hunt for the real Satoshi Nakamoto, the pseudoanonymous brain behind bitcoin. I point readers to financial analyst Felix Salmon’s blog on the subject for a good overview of the tortured investigation process and its various ambiguities:

By now, readers will likely have caught themselves up with the twists and turns of Newsweek‘s apparently ill-fated hunt for the real Satoshi Nakamoto, the pseudoanonymous brain behind bitcoin. I point readers to financial analyst Felix Salmon’s blog on the subject for a good overview of the tortured investigation process and its various ambiguities:

One way to look at this problem is to try to calculate probabilities, and do some kind of Bayesian analysis of the question, given that either Dorian is Satoshi, or he isn’t. (To make matters even more complicated, Dorian’s given name is, actually, Satoshi. But you know what I mean.) But here’s the problem: if you believe either of the two possibilities, you have to believe in a reasonably long series of improbable propositions. Call it the Satoshi Paradox: the probability that Dorian is Satoshi would seem to be very small, and the the probability that Dorian is not Satoshi would seem to be just as small — and yet, somehow, when you add the two probabilities together, the total needs to come to something close to 100%. …..[I]t’s easy to fall down a rabbit hole of second-order second-guessing. ….Personally, I don’t know whether Dorian is Satoshi — but I think I can be pretty safe in saying that the probability is somewhere in the range of, say, 10% to 90%. In other words, it’s possible; it might even be probable; but it’s not certain. And anybody who says that it is certain is wrong.

There are several analytical issues in Salmon’s “Satoshi paradox” that may be familiar to cyber security investigators trying to piece together similarly murky problems that come to mind:

- You don’t have enough reliable contextual information to effectively place even rough probabilities around respective possibilities. You are inside a murky and often contradictory environment that you barely understand, governed by dimly grasped inner workings that do not necessarily fit into an cohesive whole. The kind of information you need is widely distributed, and extracting it is costly relative to the benefits (particularly since it will always be ambiguous and tentative).

- You are dealing with an entity that may or may not be one discrete person or a group of people. Either way, it would seem that the target has deeply and carefully covered their tracks and you know very, very, little useful information about them that can cut down the search space. Dorian Nakamoto may in fact be Satoshi Nakamoto, but there is enough structural ambiguity to at least strongly suggest otherwise.

- You don’t know where to start searching, beyond a set of very obvious facts. The more you poke, the less reliable the information you acquire is. If you acquire reliable information, the more you poke the less useful the reliable information you acquire tends to be.

One of the key figures in the Newsweek story said that “humans are pattern-seeking, story-telling animals.” And this is precisely how we find ourselves going down the rabbit hole. In the face of a situation in which very little make sense, we cling very stubbornly to the narratives, clues, and ideas that would seem to get us somewhere — even if they lead us into another hall of mirrors. The great CIA counterintelligence specialist James Jesus Angleton found himself precisely traveling down such a rabbit hole, finding himself chasing phantoms while the real KGB agents did their dirty work. As the seminal rap group Geto Boys famously argued, your mind can easily play tricks on you. With enough circumstantial breadcrumbs strung together, even Taylor Swift can be a prolific poster in 4chan’s crazy digital locker room. Salmon is right, even if it may upset both defenders and opponents of Leah McGrath Goodman’s story.

Newsweek‘s story may stick, but probably not because of the strength of its analysis or reporting. As many tech figures have noted over the weekend, their investigatory process is reminiscent of the Italian police’s hunt for the serial killer known as the “monster of Florence” — equal parts rigorous investigation, sensationalistic and reckless leap in the dark, and superstitious tallying of (bitcoin equivalent) occult theories and objects. Either way, it’s doubtful that Satoshi Nakamoto’s identity is the the Rosetta stone to deciphering the mysteries of bitcoin. Bitcoin as a social trend– for better or worse — is an emergent and autocatalyzing process. And knowing the identity of Satoshi Nakamoto isn’t going to decipher that process.

Why? Well, consider it from this perspective: one man may or may not have put a paper on the Internet that famously proposed the original idea of bitcoin. Perhaps it was a collective. Or maybe it was a doge, lolcat, nyancat, or even one of Weibo’s Grass Mud Horses hooked up to a keyboard. Who can say? I for one can’t rule out Cthulhu or the Elder Gods. But the Internet — particularly its sundry regions that discuss tech — are full of oddballs and mad scientists posting technical papers or github commits. There’s even a dogescript.js, for goodness sake! Very few of these off-hours ideas become the locus of an emerging alternative to the traditional financial system! So why him? Why his paper? What made it the catalyst? Is it even a catalyst in the first place?

Nakamoto, like Ghost in the Shell Stand Alone Complex‘s Laughing Man, has become the central icon that stands in for something much bigger and interesting. There was a universe of crypto currency enthusiasts before Nakamoto. And his virtual absence from the bitcoin world after his paper didn’t stop the crypto currency world from growing. In fact, it grew and grew to something that the outside world could no longer afford to ignore. What process or causal mechanism explains that? And can we really assume that Nakamoto — man, collective, doge, or Lovecraftian creature — was the tipping point that gave us today’s crypto currency world? I don’t know the answers to those questions. Obviously knowing who or what Nakamoto is would help a great deal — but only as much as knowing about Franz Ferdinand’s killing explains why World War I began.

Good luck to Newsweek as their story is tested in the days to come. But even if they stand triumphant after all of the angry tweets, Reddit posts, and mobs of techies with pitchforks and torches trying to burn their print castle down, I don’t think we’ll necessarily know much more about bitcoin’s past, present, or future. This isn’t a case that Encyclopedia Brown can solve. Rather, it’s a caper more of the Encyclopedia Dramatica flavor.

Recent Reporting on Bitcoin:

What You Need To Know About Bitcoin: Including potential new business models to consider

OODAloop nails it again with reporting on Bitcoin price manipulation

From Crowdsourced Militias to Dread Bitcoin Pirates

Today Every Company Buys Electricity, Tomorrow Every Company Will Buy Ethereum

Smart Cities Cybersecurity Challenge

Blockchain Templates: Amazon Making Technology Mainstream

What Executives Should Know About Ethereum

Cryptocurrencies and their promise for enterprise technology professionals

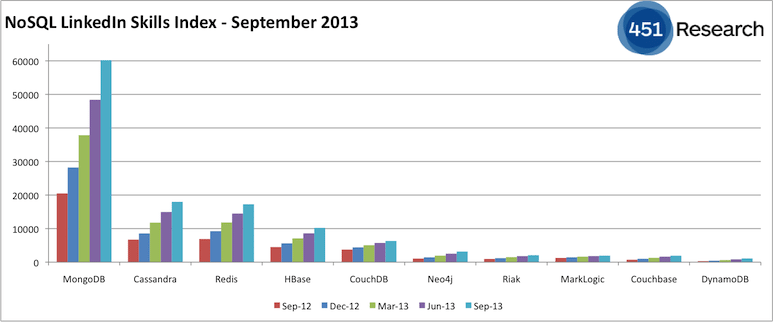

In today's world where data is everywhere the term "Big Data" may be losing some of its usefulness. The term came into widespread use in 2007 (see a short

In today's world where data is everywhere the term "Big Data" may be losing some of its usefulness. The term came into widespread use in 2007 (see a short  CTOs and analysts of all stripes know that understanding the problem they are trying to solve should precede selecting analytical tools. Yet this is far more difficult than it seems, particularly as the variety of problems we come across multiply. One of the major stumbling blocks for analysis in particular is terminological fuzziness. We often (wrongly) treat terms like “uncertain,” “difficult,” and “complex” as interchangeable — when, as economist Scott Page points out, the differences between them are instructive. Page has a useful distinction between all of these that can help us match tool to problem. And by going through his schema, I hope to convince you that there may be more possible dimensions to analytics than tools fielded by current market leaders imply.

CTOs and analysts of all stripes know that understanding the problem they are trying to solve should precede selecting analytical tools. Yet this is far more difficult than it seems, particularly as the variety of problems we come across multiply. One of the major stumbling blocks for analysis in particular is terminological fuzziness. We often (wrongly) treat terms like “uncertain,” “difficult,” and “complex” as interchangeable — when, as economist Scott Page points out, the differences between them are instructive. Page has a useful distinction between all of these that can help us match tool to problem. And by going through his schema, I hope to convince you that there may be more possible dimensions to analytics than tools fielded by current market leaders imply.

Below and at this

Below and at this  One of my favorite events of the year is

One of my favorite events of the year is